EnergyHub empowers utilities and their customers to create a

clean, distributed energy future

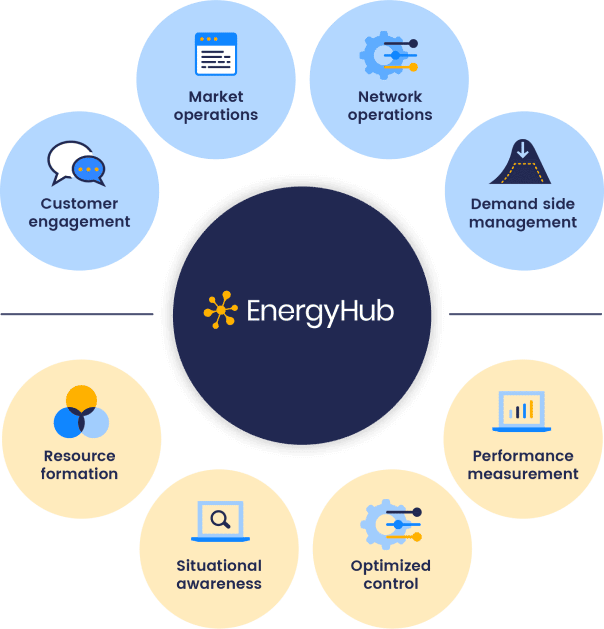

We’re transforming complexity at the grid edge into reliable resources for utilities and energy markets.

Our customers

A look at EnergyHub’s DERMS platform

Learn about the advantages of a platform designed to help utilities manage the grid edge.

Deep integrations at the grid-edge

EnergyHub represents the industry’s largest DER partner ecosystem.

Advanced grid services

The EnergyHub DERMS’ AI-enabled control optimization framework intelligently operationalizes DERs to ensure that utilities achieve desired grid objectives, while taking into consideration device- and customer-specific constraints. This entails real and reactive power optimization across the network hierarchy.

Proven scale and reliability

Industry analysts recognize that EnergyHub reliably manages the largest fleet of grid-edge resources of any DERMS provider in North America.

Thermostats

We pioneered the BYOT model and work with 50+ utilities to manage thermostats at scale.

Thermostats

We pioneered the BYOT model and work with 50+ utilities to manage thermostats at scale.

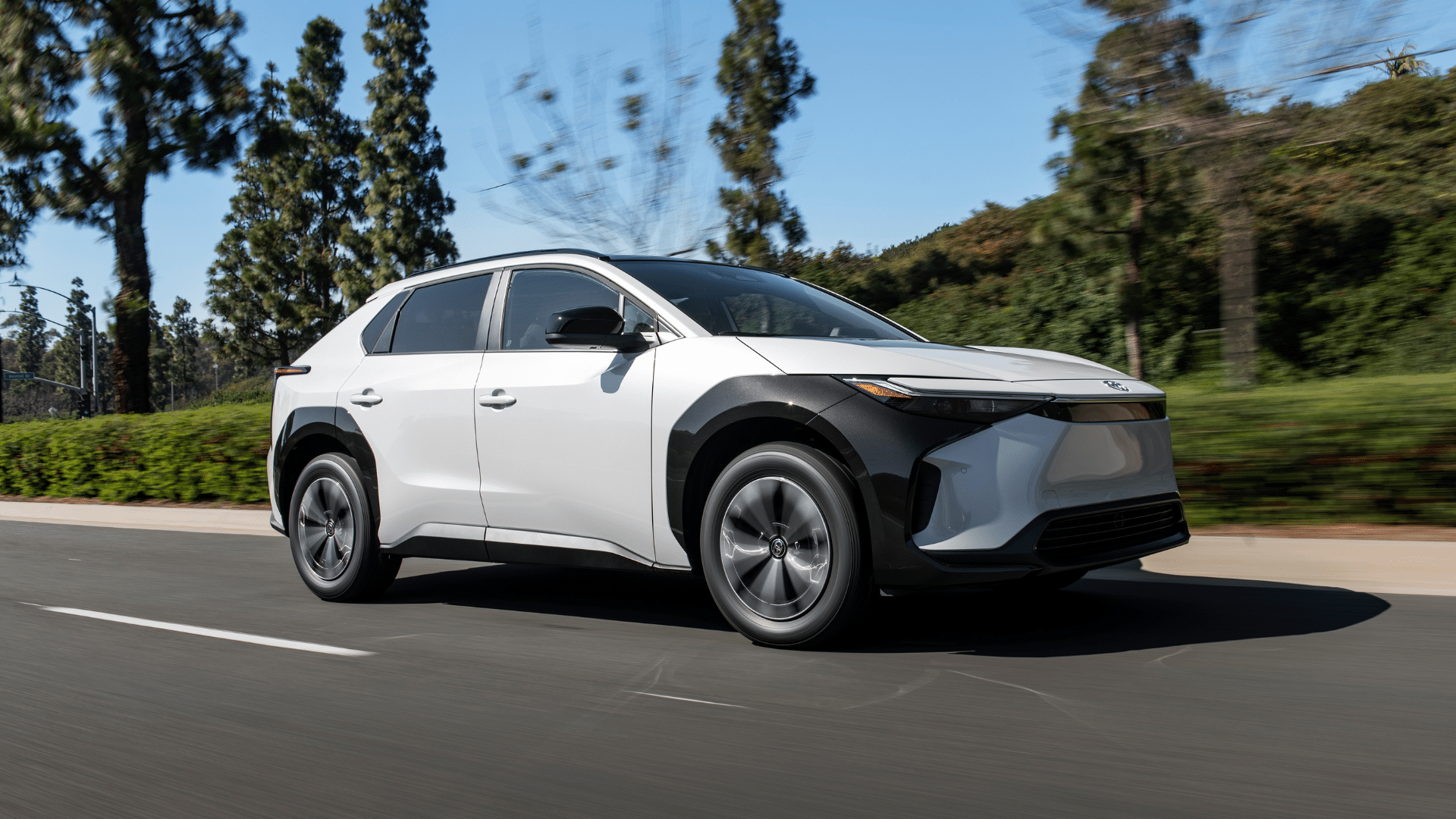

Electric vehicles

Utilities work with EnergyHub on scalable solutions to shape EV charging load.

Electric vehicles

Utilities work with EnergyHub on scalable solutions to shape EV charging load.

Batteries

We help utilities operationalize utility or customer-owned residential storage systems to support grid needs.

Batteries

We help utilities operationalize utility or customer-owned residential storage systems to support grid needs.

BYOD (bring your own device) solutions

C&I demand response

EnergyHub provides solutions to enroll, dispatch, and monitor commercial and industrial (C&I) resources, working with individual sites and leading aggregators.

Utilities can now manage C&I resources alongside residential DERs through a single platform.

DER partners

We work with the industry’s largest ecosystem of DER providers, including leading manufacturers of thermostats, EV charging equipment, residential batteries, solar inverters, and water heaters.

Client testimonials

Blog

Related Posts

Apr 16, 2024

CPower and EnergyHub partner on residential virtual power plant for Ameren customers

Ameren customers can gain rewards for contributing to grid-balancing virtual power plants through in-home smart…

READ MORE

Mar 21, 2024

Avoiding gridlock: The essential role of managed charging

This is the fourth article in EnergyHub’s four-part “Avoiding Gridlock” series on how managed charging…

READ MORE

Mar 6, 2024

EnergyHub and Toyota collaborate to support the electrical grid and improve EV ownership experience

(New York) March 6th, 2024 – EnergyHub announces that they are collaborating with Toyota Motor…

READ MOREReach out to us

We empower utilities to harness flexibility at the grid edge to meet their immediate needs and long-term strategic goals. Talk to an EnergyHub expert about your DER needs.